Filed by the Registrantý | |||

Filed by a Party other than the Registranto | |||

Check the appropriate box: | |||

Preliminary Proxy Statement | |||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

Definitive Proxy Statement | |||

o | Definitive Additional Materials | ||

o | Soliciting Material under §240.14a-12 | ||

| OM ASSET MANAGEMENT PLC | ||||||

(Name of Registrant as Specified In Its Charter) | ||||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||

Payment of Filing Fee (Check the appropriate box): | ||||||

ý | No fee required. | |||||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

| (1 | Title of each class of securities to which transaction applies: | |||||

| (2 | Aggregate number of securities to which transaction applies: | |||||

| (3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

| (4 | Proposed maximum aggregate value of transaction: | |||||

| (5 | Total fee paid: | |||||

o | Fee paid previously with preliminary materials. | |||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

| (1 | Amount Previously Paid: | |||||

| (2 | ) | Form, Schedule or Registration Statement No.: | ||||

| (3 | Filing Party: | |||||

| (4 | Date Filed: | |||||

share repurchase contracts, repurchase counterparties and repurchase authorization: Business All shareholders are cordially invited to attend the

5thGround Floor, Millennium Bridge House

2 Lambeth HillNOTICE OF 2015 ANNUAL GENERAL MEETING OF SHAREHOLDERSNOTICE OF GENERAL MEETING OF SHAREHOLDERS the 2015 annuala general meeting of shareholders (the "Annual Meeting") of OM Asset Management plc (the "Company") will be held at 3:00 p.m. GMT on Tuesday, March 15, 2016 at Old Mutual plc, 5th Floor, Millennium Bridge House, 2 p.m. Eastern Time on Friday, May 1, 2015 at the Harvard Club of New York City, 35 West 44th Street, New York, NY 10036.Lambeth Hill, London, England EC4V 4GG. Annual Meeting, the business to be conducted at the Annual Meeting, and information about the Company that you should consider when you vote your ordinary shares of the Company, nominal value $0.001 per share (the "Ordinary Shares"), are described in the accompanying proxy statement. Annual Meeting, you will be asked to consider and vote on the following proposals:1.1—Ordinary resolutions to elect directors of the Company:To elect, by way of separate resolutions, seven directors to serve on the Company's Board of Directors (the "Board") until the Company's 2016 Annual General Meeting and until their respective successors are duly elected and qualified, on the following basis:1.01—To re-elect Mr. Bain as a director of the Company;1.02—To re-elect Mr. Roberts as a director of the Company;1.03—To re-elect Mr. Gladman as a director of the Company;1.04—To re-elect Ms. Legg as a director of the Company;1.05—To re-elect Mr. Ritchie as a director of the Company;1.06—To re-elect Mr. Rogers as a director of the Company; and1.07—To re-elect Mr. Schneider as a director of the Company.2.Proposal 2—— Ordinary resolution regarding ratificationthe terms and forms of independent registered public accounting firm:ratify(i) approve the appointment of KPMG LLP ("KPMG") as the Company's independent registered public accounting firm for the year ending December 31, 2015.3.Proposal 3—Ordinary resolution to appoint KPMG as our statutory auditor:To appoint KPMG as the Company's U.K. statutory auditor under the U.K. Companies Act 2006 (to hold office until the conclusionterms and forms of the Company's next Annual General Meeting at which accounts are laid before the Company).4.Proposal 4—Ordinary resolution regarding our U.K. statutory auditor's remuneration:To authorize the directors to determine the remuneration of KPMG as the Company's U.K. statutory auditor.5.Proposal 5—Advisory resolution on executive compensation:To approve, on an advisory basis, the compensation of the Company's named executive officers as described in the accompanying proxy statement under the section titled "Executive Compensation", including the Compensation Discussion and Analysis and the tabular and narrative disclosure contained in such proxy statement.6.Proposal 6—Advisory resolution on frequency of holding an advisory vote on executive compensation.To hold an advisory vote on the frequency of holding an advisory vote on executive compensation.7.Proposal 7—Ordinary resolution on our directors' remuneration policy:To receive and approve the directors' remuneration policy contained inAppendix A to the accompanying proxy statement for the three-year period commencing on May 1, 2015 and ending on April 30, 2018.8.Proposal 8—Ordinary resolution on the directors' remuneration report:To approve, on an advisory basis, the directors' remuneration report (other than the directors' remuneration policy) contained inAppendix A to the accompanying proxy statement, for the period commencing with the date of incorporation of the Company and ending December 31, 2014.9.Proposal 9—Special resolution to adopt new Articles of Association (the "New Articles").To approve that the draft articles of association to beoff-market purchase contracts produced at the Annual Meeting and for the purposes of identification, initialed by the Chairman be adopted asfor the articlespurpose of associationidentification between the counterparty or counterparties named therein for use in effecting purchases of Ordinary Shares and to approve the counterparties with whom the Company in substitution for,may conduct such repurchase transactions and to the exclusion of, the existing articles of association of(ii) authorize the Company (the "Existing Articles"), in order to clarify certain matters set forth in the Existing Articles relatingmake off-market purchases of our Ordinary Shares, up to depositaries that hold the Company's shares.10.business.Annual Meeting and any adjournments or postponements thereof.EACH OF THE ABOVE PROPOSALS AND A VOTE FOR A FREQUENCY OF VOTING ON EXECUTIVE COMPENSATION EVERY YEAR.PROPOSAL. SUCH OTHER BUSINESS WILL BE TRANSACTED AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING.Existing Company's articles of association (the "Articles all resolutions"), the resolution will be taken on a poll. Voting on a poll means that each share represented in person or by proxy will be counted in the vote. Resolutions 1, 2, 3, 4, 5, 6, 7 and 8The resolution will be proposed as an ordinary resolutions,resolution, which under applicable law means that the resolution must be passed by a simple majority of the total voting rights of the shareholders who vote on such resolution, whether in person or by proxy. Resolution 9 will be proposed as a special resolution, which under applicable law means that the resolution must be approved by the holdersApril 2, 2015.February 26, 2016. A list of shareholders of record will be available at the Annual Meeting and, during the 10 days prior to the Annual Meeting, at our registered office.Table of ContentsAnnual Meeting.Whether you plan to attend the Annual Meeting or not, we urge you to vote in accordance with the instructions set forth in this proxy statement and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Annual Meeting.

/s/ MOLLY S. MUGLERSecretary5thApril [ ], 2015

Security Ownership of Certain Beneficial Owners and Management Shareholder Proposals and Nominations For Director MARCH 15, 2016 (i) delivered by post or by hand in hard copy form to OMAM, Ground Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at (i) delivered by post or by hand in hard copy form to OMAM, Ground Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 4GG, United Kingdom, Attention: Company Secretary or (ii) received in electronic form at you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority. What Constitutes a Quorum for the vote. executed. proxy. Audit fees:(1) Audit related fees:(2) Tax fees:(3) All other fees: Total recommend that I vote? Peter L. Bain Stephen H. Belgrad Linda T. Gibson Aidan J. Riordan Christopher Hadley 2014 Total Annual Incentive comprised of: Cash Incentive Time-vested RSA Performance-Vested RSU Peter L. Bain President & Chief Executive Officer and Director Stephen H. Belgrad Executive Vice President, Chief Financial Officer Linda T. Gibson Executive Vice President, Head of Global Distribution Aidan J. Riordan Executive Vice President, Head of Affiliate Management Christopher Hadley Executive Vice President, Chief Talent Officer Peter L. Bain Stephen H. Belgrad Linda T. Gibson Aidan J. Riordan Christopher Hadley Peter L. Bain(1) Stephen H. Belgrad Linda T. Gibson(2) Aidan J. Riordan Christopher Hadley Peter L. Bain Stephen H. Belgrad Linda T. Gibson Aidan J. Riordan Christopher Hadley Peter L. Bain Stephen H. Belgrad Linda T. Gibson Aidan J. Riordan Christopher Hadley Peter L. Bain Stephen H. Belgrad Linda T. Gibson Aidan J. Riordan Christopher Hadley Peter L. Bain Stephen H. Belgrad Voluntary Deferral Plan Linda T. Gibson Aidan J. Riordan Voluntary Deferral Plan Christopher Hadley Voluntary Deferral Plan Julian V. F. Roberts—Chairman of OMAM, Chief Executive, Old Mutual plc Don Schneider—Executive Officer, Old Mutual plc Ian Gladman—Executive Officer, Old Mutual plc Peter Bain—Chief Executive Officer, OMAM James J. Ritchie—Non-Employee Director (Chair, Audit & Risk Committee) Kyle Prechtl Legg—Non-Employee Director (Chair, Compensation Committee) John Rogers—Non-Employee Director Old Mutual plc(1)(2) FMR LLC(3) Peter L. Bain Stephen H. Belgrad Linda T. Gibson Christopher Hadley Aidan J. Riordan Julian Roberts Ian D. Gladman Kyle Prechtl Legg James J. Ritchie John D. Rogers Donald J. Schneider All directors and current executive officers as a group (11 persons) Peter L. Bain* Kyle Prechtl Legg James J. Ritchie John D. Rogers Ian D. Gladman** Julian V.F. Roberts** Donald J. Schneider**PAGEPAGE 13Proposal 2—Ratification of Appointment of Independent Registered Public Accouting Firm17Proposal 3—Appointment of KPMG as U.K. Statutory Auditors19Proposal 4—Authorization of Board of Directors to Determine U.K. Statutory Auditor Remuneration20Report of Audit Committee21Compensation Committee Report22Compensation Discussion and Analysis23Proposal 5—Advisory Resolution on Executive Compensation42Proposal 6—Advisory Resolution on Frequency of Holding an Advisory Resolution on Executive Compensation43Proposal 7—Directors' Remuneration Policy44Proposal 8—Ordinary Resolution on Directors' Remuneration Report45Proposal 9—Adoption of New Articles of Association46Information Concerning Executive Officers48Section 16(a) Beneficial Ownership Reporting Compliance53Code of Conduct and Ethics61Other Matters61Appendix A—Directors' Remuneration ReportAppendix B—New Articles of AssociationSTATEMENT—STATEMENT - SUBJECT TO COMPLETION

5th2015 ANNUAL MAY 1, 20152015 annual general meeting of shareholders (the "Annual Meeting"), contains information about the Annual Meeting, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 3:00 p.m. GMT on Tuesday, March 15, 2016 at Old Mutual plc, 5th Floor, Millennium Bridge House, 2 p.m. Eastern Time on Friday, May 1, 2015 at the Harvard Club of New York City, 35 West 44th Street, New York, NY 10036.Lambeth Hill, London, England EC4V 4GG. Unless we state otherwise or the context otherwise requires, references in this proxy statement to "Affiliates" or an "Affiliate" refer to the asset management firms in which we have an ownership interest.Annual Meeting.April [ ], 2015,February 29, 2016, we sent to our shareholders of record as of April 2, 2015February 26, 2016 this proxy statement, the attached Notice of Annual Meeting and the accompanying proxy card. On April [ ], 2015, we sent to our shareholders of record as of April 2, 2015 our Annual Report to Shareholders on Form 10-K. As permitted by the rules of the Securities and Exchange Commission (the "SEC"), we are also making our proxy materials, including the Notice of Annual Meeting, this proxy statement and the accompanying proxy card and our Annual Report to Shareholders on Form 10-K (collectively, the "proxy materials") available to all shareholders electronically via the Internet.ANNUAL MAY 1, 2015MARCH 15, 2016 Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2014 on the website of the SEC atwww.sec.gov, or in the "Public Filings" section of the "Investor Relations" section of our website atwww.omam.com.ANNUAL MEETING AND VOTINGAnnual Meeting to be held at 3:00 p.m. GMT on Tuesday, March 15, 2016 at Old Mutual plc, 5th Floor, Millennium Bridge House, 2 p.m. Eastern Time on Friday, May 1, 2015 at the Harvard Club of New York City, 35 West 44th Street, New York, NY 10036Lambeth Hill, London, England EC4V 4GG and any adjournments or postponement of the Annual Meeting. The proxy statement along with the accompanying Notice of Annual Meeting summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.Annual Meeting and the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 because you owned ordinary shares of the Company, nominal value $0.001 per share (the "Ordinary Shares"), on the record date of April 2, 2015February 26, 2016 (the "record date"). The CompanyWe completed distribution of the proxy materials to shareholders by April [ ], 2015.February 29, 2016.Annual Meeting. On the record date, there were 120,536,829121,063,817 Ordinary Shares outstanding and entitled to vote. The Ordinary Shares are our only class of voting shares. Annual Meeting, you are entitled to appoint a proxy to exercise all of your rights to attend, speak and vote at the Annual Meeting and you should have received a proxy card with this proxy statement. You can only appoint a proxy using the procedures set out in these notes and the notes to the proxy card.meetingMeeting to represent you. You may appoint more than one proxy provided that each proxy is appointed to exercise rights attached to different shares. You may not appoint more than one proxy to exercise rights attached to any one share.Annual Meeting and voting in person. If you have appointedAttending the Meeting in person will not in and of itself revoke a proxy and attend the Annual Meeting and vote in person,previously submitted proxy. To terminate your proxy appointment willyou must deliver a notice of termination to us at least 24 hours before the start of the Meeting. The notice of termination may be automatically terminated. Annual Meeting to vote your Ordinary Shares. Ordinary Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see "May I Change or Revoke My Proxy?" below. Annual Meeting or not, we urge you to vote by proxy. All Ordinary Shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your Ordinary Shares should be voted for, withheld or abstain for each nominee for director, whether your Ordinary Shares should be voted for one year, two years, three yearsagainst or abstain with respect to the frequency of voting on the compensation of our named executive officers, and whether your Ordinary Shares should be voted for, against or abstain with respect to each of the other proposals.proposal. If you properly submit a proxy without giving specific voting instructions, your Ordinary Shares will be voted in accordance with the Board's recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your Ordinary Shares are registered directly in your name through our share transfer agent, Computershare Trust Company, N.A., or you have share certificates registered in your name, you may vote:••• Annual Meeting. If you attend the Annual Meeting, you may deliver a completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting.Friday, May 1, 2015,March 15, 2016, the day of the Annual Meeting. If you properly give instructions as to your proxy appointment by telephone, through the Internet or by executing and returning a paper proxy card, and your proxy appointment is not subsequently revoked, your Ordinary Shares will be voted in accordance with your instructions. If you are a shareholder of record and you execute and return a proxy card but do not give instructions, your proxy will be voted in accordance with the Board's recommendations as noted below.Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker's proxy card and bring it to the Annual Meeting in order to vote.as follows:•the election of all nominees for director named in this proxy statement (in each case to be approved by way of a separate ordinary resolution);•"FOR" the ratificationauthorization of the appointmentterms and forms of KPMG asthe off-market purchase contracts of the Company to make off-market purchases of our independent registered public accounting firm for the 2015 fiscal yearOrdinary Shares, up to an aggregate amount of $150 million, pursuant to such contracts, by way of ordinary resolution;•"FOR" the appointment of KPMG as our U.K. statutory auditor by way of ordinary resolution;•"FOR" authorizing the Board to determine remuneration of KPMG by way of ordinary resolution;•"FOR" advisory approval of the compensation of our named executive officers by way of ordinary resolution;•"FOR" holding an advisory vote on the compensation of our named executive officers every year by way of ordinary resolution;•"FOR" receipt and approval of the directors' remuneration policy by way of ordinary resolution;•"FOR" approval of the directors' remuneration report by way of ordinary resolution; and•"FOR" the adoption of the New Articles by way of special resolution. Annual Meeting, your proxy provides that your Ordinary Shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.Annual Meeting. You may change or revoke your proxy in any one of the following ways:•••Annual Meeting that you have revoked your proxy; or•by attendingproxy in accordance with the Annual Meetingprocedures in person and voting in person. the following paragraph. Annual Meeting in person will not in and of itself revoke a previously submitted proxy. YouTo terminate your proxy appointment you must specifically requestdeliver a notice of termination to the Company at least 24 hours before the Annual Meeting that itstart of the Meeting. The notice of termination may be revoked.If your Ordinary Shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your Ordinary Shares as described above, the bank, broker or other nominee that holds your Ordinary Shares has the authority to vote your unvoted Ordinary Shares on certain routine matters without receiving instructions from you. Therefore, weWe encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your Ordinary Shares will be voted at the Annual Meeting and in the manner you desire. A "broker non-vote" will occur if your broker cannot vote your Ordinary Shares on a particular matter because it has not received instructions fromWhat proposals areThe proposal is a matter considered "routine" or "non-routine"? Proposals 2, 3 and 4 (ratification of the appointment of KPMG as the Company's independent registered public accounting firm for 2015, appointment of KPMG as our U.K. statutory auditor and authorizing our Board to determine auditor remuneration) are each considered a routine matternon-routine under the rules of the New York Stock Exchange (the "NYSE"). A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to occur in connection with Proposals 2, 3 or 4. Proposals 1, 5, 6, 7, 8 and 9 (the election of directors, the advisory vote on executive compensation, the advisory vote on the frequency of the advisory vote on executive compensation, the vote on the directors' remuneration policy, the advisory vote on the directors' remuneration report and the adoption of the New Articles in substitution of and to the exclusion of, the Existing Articles) are matters considered non-routine under the rules of the NYSE (the "NYSE Rules"). A broker, bank or other nominee may not vote on thesethe this non-routine mattersmatter without specific voting instructions from the beneficial owner. As a result, there may be broker non-votes with respect to Proposals 1, 5, 6, 7, 8 and 9.the proposal.Annual Meeting? Annual Meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known. In addition, we are required to file on a Current Report on Form 8-K no later than the earlierAnnual Meeting?presence, in person or by proxy, ofquorum for the Meeting is two persons present being either holders of a majority of the voting power of all outstanding Ordinary Shares or their representatives (in the case of a corporate holder of Ordinary Shares) or proxies appointed by holders of Ordinary Shares in relation to the Meeting and entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of shareholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.Annual Meeting Annual Meeting will be held at 3:00 p.m. GMT on Tuesday, March 15, 2016 at Old Mutual plc, 5th Floor, Millennium Bridge House, 2 p.m. Eastern Time on Friday, May 1, 2015 at the Harvard Club of New York City, 35 West 44th Street, New York, NY 10036.Lambeth Hill, London, England EC4V 4GG. When you arrive at the Harvard Club,Old Mutual plc, signs will direct you to the appropriate meeting rooms. You need not attend the Annual Meeting in order to vote. annual disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our shareholders reside, if we or your broker believe that the shareholders are members of the same family. This practice, referred to as "householding," benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be "householded," the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Shareholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.the Company'sour proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another OMAM shareholder and together both of you would like to receive only a singleset of proxy materials, follow these instructions:••Website Publication Under section 527— SHARE REPURCHASE CONTRACTS, REPURCHASE COUNTERPARTIES AND REPURCHASE AUTHORIZATIONUKoff-market share purchase contracts produced at the Meeting and initialed by the Chairman for the purpose of identification between the counterparty or counterparties named therein for use in effecting off-market purchases of Ordinary Shares and (ii) authorize our company to make off-market purchases of our Ordinary Shares from the counterparty or counterparties named in such off-market purchase contracts, up to an aggregate amount of $150 million, pursuant to such contracts, such authority to expire on the fifth anniversary of the date on which the shareholders' resolution is approved.shareholder or shareholders meetingrecognized investment exchange for purposes of English law, thus, solely for the criteria set out in the following paragraphs, have the right to request the Company to publish on its website a statement setting out any matter that such shareholders propose to raise at the annual meeting relating to the auditpurposes of the Company's accounts.TableAct, any repurchase of Contents Where the Company is required to publish such a statement on its website:•it may not require the shareholders making the request to pay any expenses incurred by the Company in complying with the request;•it must forward the statement to the Company's auditors no later than the time the statement is made available on the Company's website; and•the statement must be dealt with as part of the business of the annual meeting. The request (i) may be in hard copy form or in electric form, (ii) must either set out the statement in full or, if supporting a statement sent by another shareholder, clearly identify the statement which is being supported, (iii) must be authenticated by the person or persons making it, and (iv) must be received by the Company at least one week before the meeting. In order to be able to exercise the shareholders' right to require the Company to publish audit concerns, the relevant request must be made by either (a) a shareholder or shareholders having a right to vote at the annual meeting and holding at least 5% of the issued and outstandingour Ordinary Shares ofthrough the Company, or (b) at least 100 shareholders having a right to vote at the annual meeting and holding, on average, at least £100 of paid up share capital. Where a shareholder or shareholders wish to request the Company to publish audit concerns,New York Stock Exchange constitutes an "off-market" transaction. As such, request must be made by either sending (a) a hard copy request which is signed by the relevant shareholder(s), stating their full name(s) and address(es) to OM Asset Management plc, 5th Floor, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG Attention: Company Secretary, or (b) a request which states the full name(s) and address(es) of the relevant shareholder(s) toinfo@omam.com. Any e-mail addressed to the Company pursuant to sub-paragraph (b) above should be entitled "AGM—Shareholder Audit Concerns" in the subject line of the e-mail. PROPOSAL 1—ELECTION OF DIRECTORS Our business and affairs are managed under the direction of our Board. On February 4, 2015, our Board accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate Messrs. Peter L. Bain, Julian Roberts, Ian D. Gladman, James J. Ritchie, John D. Rogers and Donald J. Schneider and Ms. Kyle Prechtl Legg for election at the Annual Meeting to serve as directors, until their respective successors have been elected and qualified. Each of the nominees is currently serving as a director of the Company. Set forth below are the names of the nominees, their ages, their offices in the Company, if any, their principal past occupations or past employment, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board's conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below. The biographical and other background information set forth below concerning each nominee for re-election as a director is as of April [ ], 2015.NameAgePosition with the CompanyMr. Peter L. Bain56President, Chief Executive Officer and DirectorMr. Julian Roberts57Chairman of the BoardMr. Ian D. Gladman50DirectorMs. Kyle Prechtl Legg63DirectorMr. James J. Ritchie60DirectorMr. John D. Rogers53DirectorMr. Donald J. Schneider57Director Each of the seven directors willAct, these repurchases may only be elected by way of a separate ordinary resolution. A shareholder may (i) vote for the election of a nominee for director, (ii) withhold their vote for the election of a nominee for director or (iii) abstain from voting for a nominee for director. Unless a proxy contains instructions to the contrary, it is intended that the proxies will be voted FOR each of the separate resolutions relating to the re-election of each of the seven nominees for director named above, to hold office until the 2016 annual general meeting of shareholders or until their respective successors are duly elected and qualified. We have no reason to believe that any of the nominees will not be available to serve as a director. However, if any nominee should become unavailable to serve for any reason, the proxies will be voted for such substitute nominees as may be designated by the Board.THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE RE-ELECTION OF ALL NOMINEES.Peter L. Bain is our President, Chief Executive Officer and a member of our Executive Management Team. Mr. Bain has held these positions since joining OMAM Inc. in February 2011. Mr. Bain has also been a director of the Company since 2014 and a director of OMAM Inc., our limited U.S.-based holding company for our affiliate firms, since February 2011. Mr. Bain is responsible for all aspects of our operations, including corporate strategy and development. Mr. Bain also is a member of the Group Executive Committee of Old Mutual plc (our "Parent"). Prior to joining OMAM Inc., Mr. Bain held executive positions with Legg Mason, Inc., a global asset management company, from June 2000 until March 2009, including senior executive vice president and head of affiliate management and corporate strategy from 2008 until March 2009 and chief administrative officer from 2003 until 2006. From March 2009 until February 2011, Mr. Bain was not employed. Mr. Bain received a B.A. in American Studies from Trinity College, where he was elected to Phi Beta Kappa and graduated with honors in general scholarship, and a J.D. from Harvard Law School. Mr. Bain's qualifications to serve on our Board include his extensive business, finance, distribution, marketing and leadership skills gained and developed through years of experience in the financial services industry. In particular, Mr. Bain has overseen a substantial number of transactions in the asset management sector and has significant expertise in identifying, structuring and executing strategic acquisitions, as well as in managing boutique firms post-acquisition. These skills, combined with Mr. Bain's extensive knowledge of our business and our industry, will enable him to provide valuable insights to the Board on the strategic direction of our Company.Julian Roberts has been the Chairman of our Board since 2014. Mr. Roberts has been the Group Chief Executive of our Parent since September 2008 and a director of our Parent since August 2000. During his tenure as Chief Executive of our Parent, Mr. Roberts led the successful recapitalization of our Parent through the sale of non-core businesses in the U.S. and Europe and is responsible for our Parent's strategy and values. Mr. Roberts is a non-executive director of Nedbank Group Limited, Nedbank Limited and Old Mutual Life Assurance Company (South Africa) Limited ("OMLACSA"). He joined our Parent in August 2000 as Group Finance Director, moving on to become the group chief executive of Skandia, an investment services firm, following its purchase by our Parent in February 2006. Prior to joining our Parent, he was the group finance director of Sun Life & Provincial Holdings plc, an insurance company, and, before that, the chief financial officer of Aon UK Holdings Limited, a professional services company. Mr. Roberts received a BA in accountancy and business law from the University of Stirling. He is a Fellow of the Institute of Chartered Accountants, a Member of the Association of Corporate Treasurers and a Member of TheCityUK. Mr. Roberts's qualifications to serve on our Board include his extensive business, finance, operational and leadership skills gained and developed through years of experience in the financial services industry. In particular, Mr. Roberts has substantial experience managing and leading a firm in the financial services industry. These skills, combined with Mr. Roberts' extensive knowledge of our business and our industry, will enable him to provide valuable insights to the Board on our strategic direction.Ian D. Gladman has been a member of our Board since 2014. Since January 2012, Mr. Gladman has been the Group Strategy Director and a member of the Group Executive Committee of our Parent. He previously worked at UBS Investment Bank ("UBS") for sixteen years where his most recent position, commencing in March 2008 and ending in June 2010, was as Co-Head of Financial Institutions, EMEA, covering a range of U.K. and European insurance companies, banks and asset managers. During his time at UBS, Mr. Gladman advised a number of asset managers on initial public offerings and other strategic transactions. While at UBS, Mr. Gladman also served as Head of Corporate Finance South Africa from 1998 to 2001, during which time he led the local UBS team advising our Parent on its demutualization and original listing. Prior to joining UBS, Mr. Gladman worked at Goldman Sachs and JP Morgan. Mr. Gladman was appointed a non-executive director of Nedbank Group Limited in June 2012 and serves on the Group Credit Committee, Group Risk and Capital Management Committees, Group Finance and Oversight Committee and Large-Exposure Approval Committee of Nedbank. Mr. Gladman is also a director of Rogge Global Partners plc and UAM UK Holdings Ltd. Mr. Gladman received a B.A. in History from Christ's College, Cambridge. Mr. Gladman took sabbatical leave from UBS from June 2010 until June 2011. From June 2011 until January 2012, he was not employed. Mr. Gladman's qualifications to serve on our Board include his in-depth knowledge and experience in financial services, in particular his experience in the asset management sector, which has included working with numerous companies on advisory and capital markets transactions. In addition, Mr. Gladman has deep experience in both the debt and equity global capital markets and has workedwith investors in a range of jurisdictions. He has worked on numerous initial public offerings, rights issues, demutualizations and other listings in the United Kingdom, U.S. and other markets.Kyle Prechtl Legg has been a member of our Board since 2014. Ms. Legg is the former Chief Executive Officer of Legg Mason Capital Management (now ClearBridge Investments), an investment management firm and equity affiliate of Legg Mason, Inc., where she served as Chief Executive Officer from 2006 until her retirement in 2009 and as President from 1997 to 2006. Ms. Legg joined Legg Mason in 1991 as a Vice President and Senior Analyst. At Legg Mason, Ms. Legg built a leading global equity investment management business serving high-end institutional clients, including some of the world's largest sovereign wealth funds, domestic and foreign company pension plans, corporate funds, endowments, and foundations. Prior to joining Legg Mason, Ms. Legg began her career as a Securities Analyst at Alex Brown & Sons. Ms. Legg currently is a member of the board of directors, audit committee and executive committee, and is chair of the compensation committee, of SunTrust Banks, Inc. Ms. Legg previously served as a director of Eastman Kodak Company from September 2010 to September 2013 and as a member of its Corporate Responsibility and Governance Committee and its Executive Compensation and Development Committee. Ms. Legg, a Chartered Financial Analyst, received a B.A. in mathematics from Goucher College, a J.D. from the University of Baltimore and an M.B.A. from Loyola College. Ms. Legg's deep investment, financial, and executive leadership experience, including experience with a regulated financial institution, qualify her to serve on our Board.James J. Ritchie has been a member of our Board since 2014. Mr. Ritchie has served as a director of OMAM Inc. since January 2007 and as chairman and a member of the audit and risk committee of the board of directors of OMAM Inc. since August 2007. Mr. Ritchie also has served as a member of the board and chairman of the audit committee of Kinsale Capital Group, Ltd. since January 2013 and as a member of the board and chairman of the audit committee of Old Mutual (Bermuda) Ltd. since February 2009. Mr. Ritchie's former board experience includes: member of the board and chairman of the audit committee of Ceres Group, Inc.; member and non-executive chairman of the board and member of the compensation committee of Fidelity & Guaranty Life Insurance Company (formerly Old Mutual Financial Life Insurance Company, Inc.); member of the board and member of the audit and compensation committees of KMG America Corporation; member of the board, chairman of the audit committee and member of the compensation committee of Lloyd's Syndicate 4000; and member and non-executive chairman of the board and former chairman of the audit committee of Quanta Capital Holdings Ltd. From 2001 until his retirement in 2003, Mr. Ritchie served as managing director and chief financial officer of White Mountains Insurance Group, Ltd.'s OneBeacon Insurance Company, a specialty insurance company, and as the group chief financial officer for White Mountains Insurance Group, Ltd., a financial services holding company. From 1986 through 2000, Mr. Ritchie held various positions with CIGNA Corporation, an insurance company, including chief financial officer of the company's international division and head of its internal audit division. Mr. Ritchie began his career with PricewaterhouseCoopers LLP, an accounting firm. Mr. Ritchie is a member of the National Association of Corporate Directors and the American Institute of Certified Public Accountants. Mr. Ritchie received a B.A. in economics with honors from Rutgers College and an M.B.A. from Rutgers Graduate School of Business Administration. Mr. Ritchie's qualifications to serve on our Board include his extensive background in finance, substantial board experience, strategic and operational leadership and wide-ranging knowledge of operational, risk and control initiatives. His background in financial risk and regulation will provide valuable guidance to our Board and our Company in addressing risk management.John D. Rogers has been a member of our Board since 2014. Mr. Rogers is the former President, Chief Executive Officer and a member of the Board of Governors of CFA Institute, the world's largest association of investment professionals. Mr. Rogers served in these positions from January 2009through May 2014. From May 2007 through December 2008, Mr. Rogers was the principal and founding partner in Jade River Capital Management, LLC, an investment adviser located in Atlanta, Georgia that served high net worth clients. From 1994 to 2007, Mr. Rogers served in several roles at Invesco Ltd., a global investment management firm, as President and Chief Investment Officer of Invesco Asset Management Ltd. (Japan), as Chief Executive Officer and Co-Chief Investment Officer of Invesco Global Asset Management, N.A., and as Chief Executive Officer of Invesco's Worldwide Institutional Division. Mr. Rogers has not been employed since May 2014. Since July 2009, Mr. Rogers has served on the board of directors and the audit committee, which he currently chairs, of Schweitzer-Mauduit International, Inc. Mr. Rogers previously served on the board of directors of AMVESCAP plc (now Invesco Ltd.). Mr. Rogers, a Chartered Financial Analyst, received a B.A. in history from Yale University and an M.A. in East Asian studies from Stanford University. Mr. Roger's qualifications to serve on our Board include his extensive investment expertise, his business-building experiences in the global asset management industry and his various business and professional leadership roles. These skills will enable Mr. Rogers to provide our Board with a global perspective on the asset management business as well as the leadership expertise to help guide the growth of our business.Donald J. Schneider has been a member of our Board since 2014 and has served as a director of OMAM Inc. since November 2009. Mr. Schneider has been Group Human Resources Director at our Parent since May 2009. He is based in London and is responsible for all human resources functions globally. Prior to joining our Parent, Mr. Schneider was Senior Vice President and Head of Human Resources for the Global Wealth Management Division of Merrill Lynch & Co., a financial services firm. Mr. Schneider originally joined Merrill Lynch in 1997 as Head of International Human Resources, based in London, where he was responsible for all human resource activities outside of the U.S. He later served as Head of Human Resources for Global Markets and Investment Banking. Previously, Mr. Schneider worked for Morgan Stanley & Co. LLC, a financial services firm, and held a variety of senior human resource roles, including Global Head of Compensation, Benefits and Human Resource Systems. Mr. Schneider received a B.A. in economics and English from Hamilton College, an M.A. in industrial relations from the University of Warwick and a Certificate in Corporate Governance from INSEAD. Mr. Schneider's qualifications to serve on our Board include the breadth of his international business knowledge and experience in several sectors of financial services. His expertise in the field of human resources will provide our Board and our Company with professional guidance in the growth and development of our business, competitive compensation strategies and talent management.Director Independence Our business and affairs are managed under the direction of our Board. Our Board has an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. As discussed under "Certain Relationships and Related Party Transactions—Relationship with Our Parent and OMGUK—Shareholder Agreement—Board and Corporate Governance Rights,"made pursuant to a Shareholder Agreementshare repurchase contract which has been authorized by our shareholders. This authorization, if granted, will be valid for five years commencing on the date of the general meeting.have entered into with our Parent and OM Group (UK) Limited ("OMGUK") dated September 29, 2014 (the "Shareholder Agreement"), our Parent has the right to appoint certainwill repurchase any of our directorsown Ordinary Shares or as to the Board (which we refer to as Parent Group Directors) andamount of any such repurchases or the right to increaseprices at which such repurchases may be made.size of our Board from seven to nine directors. Because our Parent, through OMGUK, indirectly owns a majoritymaterial terms of the repurchase contracts?we are a "controlled company" for purposes ofits own account on the NYSE Rules. Accordingly, our Board is not required to have a majority of independent directors,New York Stock Exchange at such prices and our Compensation Committee and Nominating and Corporate Governance Committee are not required to meet the director independence requirements to which we would otherwise be subject untilin such timequantities as we ceasemay instruct from time to be a "controlled company." We currently utilize eachtime, subject to the limitations set forth in Rule 10b-18 of these exemptions from the requirements of the NYSE Rules for our Board, Compensation Committee and Nominating and Corporate Governance Committee. Our Board has determined that Ms. Legg and Messrs. Ritchie and Rogers are independent under the NYSE Rules. In considering their independence, the Board considered the relationships between Mr. Ritchie, on the one hand, and our Company and our Parent, on the other hand.Committees of the Board and MeetingsMeeting Attendance During the fiscal year ended December 31, 2014 and since inception of OMAM on May 29, 2014, there was one formal meeting of the Board, and the various committees of the Board met a total of four times (three Audit Committee meetings and one Compensation Committee meeting). In addition, since inception of OMAM, the Board acted by written consent numerous times during the fiscal year ended December 31, 2014. No director attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal year 2014. The Board has adopted a policy under which each member of the Board is expected to attend each annual general meeting of our shareholders absent exigent circumstances that prevent their attendance.Audit Committee Our Audit Committee met three times during fiscal year 2014. The Audit Committee is composed of Ms. Legg and Messrs. Ritchie and Rogers, and Mr. Ritchie is the Chair. The Board has determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the Ordinary Shares so purchased by the counterparty to be repurchased by us in accordance with the share repurchase contract.NYSE Rules andtotal amount that may be purchased under the contract will be determined at the time the plan is "financially literate" as such term is defined in the NYSE Rules. Our Board has determined that Mr. Ritchie is an "audit committee financial expert" within the meaning of SEC regulations and the NYSE Rules.Audit Committee has a charter that sets forth the Audit Committee's purpose and responsibilities, which include (i) assisting the Board in fulfilling its oversight responsibilitiesparticular contracts with each of the financial reportscounterparties will be produced at the Meeting for review and other financial information filedauthorization pursuant to the resolution. The particular contracts will also be made available for inspection by our shareholders at our registered office for not less than 15 days ending with the SEC, (ii) recommending to the Board the appointment of our independent auditors and evaluating their independence, (iii) reviewing our audit procedures and controls, and (iv) overseeing our internal audit function and risk and compliance function. Please also see the reportdate of the Audit Committee set forth elsewhere in this proxy statement.Meeting. A copy ofAudit Committee's written charter is publicly available on our website atwww.omam.com.Compensation Committee Our Compensation Committee met one time during fiscal year 2014. The Compensation Committee is composed of Ms. Legg and Messrs. Roberts and Rogers, and Ms. Legg iscounterparties with whom the Chair. Our Board has determined that Ms. Legg and Mr. Rogers are independent under the NYSE Rules. At such time as our Parent ceasesshare repurchase contracts will be entered into?own more than 50%conduct repurchases of our outstanding Ordinary Shares pursuant to the Compensation Committee must consist solely of independent directors. The Compensation Committee has a charter that sets forthshare repurchase contracts with the Compensation Committee's purpose and responsibilities, which include annually reviewing and approving the compensation offollowing counterparty (or its subsidiaries or affiliates from time to time): executive officers and reviewing and making recommendations with respect to our equity incentive plans. Until such time as our Parent ceases to own more than 50% of our outstanding Ordinary Shares (i) the charter of the Compensation Committee may not be amended without the consent of our Parent, (ii) all compensation decisions made by the Compensation Committee will be subjectpursuant to the approvalforms of our Parent and (iii)contract produced at the policies adopted by the Compensation Committee must be consistent with the policies of our Parent. The Compensation Committee's processes and procedures for the consideration and determination of executive compensation as well as disclosure regarding the role of the Company's compensation consultants are set forth below in "Compensation Discussion and Analysis." A copy of the Compensation Committee's written charter is publicly available on our website atwww.omam.com. Please also see the report of the Compensation Committee set forth elsewhere in this proxy statement.Directors' Remuneration Reports Under Section 385 of the U.K. Companies Act 2006, we are required to produce a directors' remuneration report for each fiscal year. Directors' remuneration reports must include (i) a directors' remuneration policy, which is subject to a binding shareholder vote at least once every three years, and (ii) an annual report on remuneration in the financial year being reported on, and on how the current policy will be implemented in the next financial year, which is subject to an annual advisory shareholder vote. The U.K. Companies Act 2006 requires that remuneration payments to executive directors of the Company and payments to them for loss of office must be consistentMeeting with the approved directors' remuneration policy or,counterparties until the fifth anniversary of the Meeting. not, must be specifically approved by the shareholders at a general meeting.Nominating and Corporate Governance Committee Our Nominating Committee did not meet during fiscal year 2014. The Nominating and Corporate Governance Committee is composed of Messrs. Ritchie, Roberts and Rogers, and Mr. Roberts is the Chair. Our Board has determined that Messrs. Ritchie and Rogers are independent under the NYSE Rules. At such time as our Parent ceases to own more than 50% of our outstanding Ordinary Shares, the Nominating and Corporate Governance Committee must consist solely of independent directors. The Nominating and Corporate Governance Committee has a charter that sets forth the Committee's purpose and responsibilities, which include reviewing and recommending nominees for election as directors, assessing the performance of our directors and reviewing corporate governance guidelines for our Company. Until such time as our Parent ceases to own more than 50%simple majority of the Ordinary Shares, the charter of the Nominating and Corporate Governance Committee may not be amended without the consent of our Parent. Under our current corporate governance policies, the Nominating Committee may consider candidates recommended by shareholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Nominating Committee may consider all factors it deems relevant, such as a candidate's integrity, personal and professional reputation, experience and expertise, business judgment, ability to devote time, possible conflicts of interest, concern for the long-term intereststotal voting rights of the shareholders independence, range of backgrounds and experience and the extent to which the candidate would fill a present needwho vote on the Board. In general, persons recommendedsuch resolution, whether in person or by shareholders will be considered on the same basis as candidates from other sources. If a shareholder wishes to nominate a candidate for director who is not to be included in our proxy statement, it must follow the procedures described in the Existing Articles and in "Shareholder Proposals and Nominations For Director" at the end of this proxy statement. Although the Nominating Committee does not have a formal policy with regard to diversity, the Nominating Committee considers a broad range of backgrounds and experiences as well as gender, ethnic and other forms of diversity when selecting potential nominees for membership on the Board. A copy of the Nominating Committee's written charter is publicly available on the Company's website atwww.omam.com.Executive Sessions of Non-Executive DirectorsNYSE rules and our Corporate Governance Guidelines, our non-executive directors meet in regularly scheduled executive sessions without management present. The Chairarticles of these executive sessions is an informal position and no one director has been chosen to preside as Chair over all of these executive sessions. Each session is presided over by such director as the participants of the particular executive session so determine. When an executive session followsassociation, a meeting of the Audit Committee, the Chair of the Audit Committee typically chairs the executive session.Board Leadership Structure and Role in Risk Oversight Mr. Bain serves as our President and Chief Executive Officer and Mr. Roberts serves as the Chairman of our Board. The Board has no set policy with respectresolution put to the separation of the offices of Chairman and the Chief Executive Officer. The Board believes that this issue is part of the succession planning process and that it is in the best interest of the Company for the Board to make a particular determination in the context of the succession planning process. The Board oversees the business and affairs of the Company including all aspects of risk, which includes risk assessment, risk appetite and risk management. In executing its risk oversight function, the Board has delegated to the Audit Committee the direct oversight over risk functions. However, the Audit Committee is not responsible for day to day management of risk. The Audit Committee reviews and subsequently reports to the Board any issues which arise with respect to the performance of the Company's risk function including operational risks and risks relating to the quality or integrity of the Company's financial statements. The Audit Committee also, at least annually, reviews the Company's policies with respect to risk assessment, risk appetite and risk management and recommends the risk appetite contained in the business plan to the Board for approval.Compensation Committee Interlocks and Insider Participation The members of the Compensation Committee during fiscal year 2014 are set forth above under "—Compensation Committee". No member of the Compensation Committee was, during fiscal year 2014, or previously, an officer or employee of OMAM. Mr. Roberts, a member of our Compensation Committee, has been the Group Chief Executive of our Parent since September 2008 and a director ofour Parent since August 2000. Mr. Roberts is also a member of the nomination committee of our Parent and a non-executive director of Nedbank Group Limited, Nedbank Limited and OMLACSA. Mr. Bain is a member of the Group Executive Committee of our Parent. Our Chief Financial Officer, Stephen H. Belgrad, is a member of the Group Capital Management Committee of our Parent. No executive officer of the Company serves on the compensation committee or board of directors of another company that has an executive officer that serves on the Company's Compensation Committee or Board.Shareholder Communications to the Board Generally, shareholders who have questions or concerns should contact our Investor Relations department at (617) 369-7300. However, any shareholders who wish to address questions regarding our business directly with the Board, or any individual director, should direct his or her questions in writing to the Board of OMAM at 5th Floor, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG. Communications will be distributed to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Shareholders may communicate directly with the non-executive directors by sending a letter addressed to the attention of the Non-Executive Directors of OMAM, 5th Floor, Millennium Bridge House, 2 Lambeth Hill, London, England EC4V 4GG. Items that are unrelated to the duties and responsibilities of the Board may be excluded, such as:•junk mail and mass mailings;•resumes and other forms of job inquiries;•surveys; and•solicitations or advertisements. In addition, any material that is unduly hostile, threatening, or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any outside director upon request.PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit Committee has appointed KPMG, as our independent registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2015. The Board proposes that the shareholders ratify this appointment. KPMG audited our financial statements for the fiscal year ended December 31, 2014. We expect that representatives of KPMG will be present at the Annual Meeting, will be able to make a statement if they so desire, and will be available to respond to appropriate questions. In deciding to appoint KPMG, the Audit Committee reviewed auditor independence issues and existing commercial relationships with KPMG and concluded that KPMG has no commercial relationship with the Company that would impair its independence for the fiscal year ending December 31, 2015. The following table presents fees for professional audit services rendered by KPMG for the audit of the Company's annual financial statements for the years ended December 31, 2014, and December 31, 2013, and fees billed for other services rendered by KPMG during those periods. 2014 2013 $ 1,428,000 $ 957,335 $ 3,169,554 $ 908,903 $ 31,700 $ 50,184 $ — $ — $ 4,629,254 $ 1,916,422 (1)Audit fees consisted of audit work performed in the preparation of financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as statutory audits.(2)Audit related fees consisted principally of audits of employee benefit plans, and special procedures related to regulatory filings.(3)Tax fees consist principally of assistance with matters related to domestic and international tax compliance and reporting.The Audit Committee has not approved any services set forth above in the categories audit related fees, tax fees and all other fees, pursuant to Rule 2-01(c)(7)(i)(C) (relating to the approval of a de minimis amount of non-audit services after the fact but before completion of the audit).Audit Committee Pre-Approval Policies and Procedures Subject to any necessary approvals required from the Company's shareholders pursuant to the U.K. Companies Act 2006, the Audit Committee has the sole authority to approve the scope, fees and terms of all audit engagements, as well as all permissible non-audit engagements of the independent registered public accounting firm (together with the U.K. statutory auditor, the "External Auditor"). Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the External Auditor. The Audit Committee pre-approves all audit and permissible non-audit services to be performed for the Company by the External Auditor. These services may include audit services, audit-related services, tax services and other services. On an annual basis, the Audit Committee considers whether the provision of non-audit services by our External Auditor, on an overall basis, is compatible with maintaining the External Auditor's independence from management. In addition to the pre-approval procedures described immediately above, the Audit Committee has adopted a written Pre-Approval Policy for Non-Audit Services Provided by External Accounting Firms (the "Non-Audit Services Policy"). Under the Non-Audit Services Policy, the Audit Committee must pre-approve the provision of non-audit services to be performed for the Company by any external accounting firm, subject to a de minimis threshold. Requests for non-audit services to be performed for the Company by an external auditor are submitted to the Chair of the Audit Committee via written request. The Chair of the Audit Committee reviews the request with the other members of the Audit Committee and the Audit Committee determines whether to approve the request. The Non-Audit Services Policy sets forth certain non-audit services prohibited to be performed by external accounting firms. No hours expended on KPMG's engagement to audit our financial statements for the fiscal year ended December 31, 2014 were attributed to work performed by persons other than KPMG's full-time, permanent employees. In the event the shareholders do not ratify the appointment of KPMG as our independent registered public accounting firm, the Audit Committee will reconsider its appointment. The affirmative vote of a majority of the Ordinary Shares cast affirmatively or negatively at the Annual Meeting is required to ratify the appointment of the independent registered public accounting firm.THE BOARD UNANIMOUSLY RECOMMENDS A VOTE TO RATIFY THE APPOINTMENT OF KPMG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2015, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH RATIFICATION UNLESS A SHAREHOLDER INDICATES OTHERWISE ON THE PROXY.PROPOSAL 3—APPOINTMENT OF KPMG AS THE COMPANY'S U.K. STATUTORY AUDITORS UNDER THE U.K. COMPANIES ACT 2006 (TO HOLD OFFICE UNTIL THE CONCLUSION OF THE NEXT ANNUAL GENERAL MEETING AT WHICH ACCOUNTS ARE LAID BEFORE THE SHAREHOLDERS). Under the U.K. Companies Act 2006, our U.K. statutory auditors must be appointed at each general meeting at which the annual report and accounts are presented to shareholders. If this proposalshall be decided on a poll. A poll is a vote whereby each shareholder has one vote for each share held. not receive the affirmative vote of the holders of a majority of the Ordinary Shares entitled to vote and present in person or represented by proxy at the Annual Meeting, the Board may appoint an auditor to fill the vacancy.THE APPOINTMENT OF KPMG AS OUR U.K. STATUTORY AUDITORS UNDER THE U.K. COMPANIES ACT 2006 (TO HOLD OFFICE UNTIL THE CONCLUSIONAUTHORIZATION OF THE NEXT ANNUAL GENERAL MEETING AT WHICH ACCOUNTS ARE LAID BEFORE THE SHAREHOLDERS).FORMS OF SHARE REPURCHASE CONTRACT AND AUTHORIZATION OF REPURCHASES MADE PURSUANT TO THEM.PROPOSAL 4—AUTHORIZATION OF THE BOARD TO DETERMINE THE COMPANY'S U.K. STATUTORY AUDITOR'S REMUNERATION Under the U.K. Companies Act 2006, the remuneration of our U.K. statutory auditor must be fixed in a general meeting or in such manner as may be determined in a general meeting. We are asking our shareholders to authorize our Board to determine KPMG's remuneration as our U.K. statutory auditor.THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE AUTHORIZATION OF THE BOARD TO DETERMINE OUR U.K. STATUTORY AUDITOR'S REMUNERATION. The Audit Committee is composed of Ms. Legg and Messrs. Ritchie and Rogers and Mr. Ritchie is the Chair. Our Board has determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the NYSE Rules and is "financially literate" as such term is defined in the NYSE Rules. Our Board has determined that Mr. Ritchie is an "audit committee financial expert" within the meaning of SEC regulations and the NYSE Rules. The Audit Committee assists the Board in fulfilling its oversight responsibilities of the financial reports and other financial information filed with the SEC, recommends to the Board the appointment of OMAM's independent auditors and evaluates their independence, reviews OMAM's financial reporting procedures and controls, and oversees OMAM's internal audit function, risk and compliance functions. The Audit Committee's role and responsibilities are set forth in the Audit Committee Charter adopted by the Board, which is available on OMAM's website atwww.omam.com. The Audit Committee reviews and reassesses its charter annually and recommends any changes to the Board for approval. The Audit Committee is responsible for overseeing OMAM's overall financial reporting process, and for the appointment, compensation, retention, and oversight of the work of KPMG. In fulfilling its responsibilities for the financial statements for fiscal year 2014, the Audit Committee took the following actions:•Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2014 with management and KPMG, our independent registered public accounting firm;•Discussed with KPMG the matters required to be discussed in accordance with Auditing Standard No. 16—Communications with Audit Committees;•Received written disclosures and the letter from KPMG regarding its independence as required by applicable requirements of the Public Company Accounting Oversight Board regarding KPMG communications with the Audit Committee and the Audit Committee further discussed with KPMG their independence. The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the committee determined appropriate;•Discussed with KPMG, as OMAM's U.K. statutory auditor, the conformity of OMAM's financial statements with the requirements of the U.K. Companies Act 2006;•Discussed with KPMG, as OMAM's U.K. statutory auditor, the matters that are required to be discussed under the U.K. Companies Act 2006; and•Discussed with KPMG, as OMAM's U.K. statutory auditor, the independence of KPMG from OMAM and its management and concluded that KPMG is independent. Based on the Audit Committee's review of the audited financial statements and discussions with management and KPMG, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 for filing with the SEC.Members of the OMAM Audit CommitteeJames J. Ritchie (Chair)Kyle Prechtl LeggJohn D. Rogers The Compensation Committee of our Board has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K, which appears elsewhere in this proxy statement, with our management. Based on this review and discussion, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in our proxy statement and incorporated into OMAM's Annual Report on Form 10-K.Members of the OMAM Compensation CommitteeKyle Prechtl Legg (Chair)Julian RobertsJohn D. RogersCOMPENSATION DISCUSSION AND ANALYSIS—PART IExecutive Summary We welcome the opportunity to provide information on the material components of our compensation programs. Because OMAM is subject to disclosure requirements in the U.S. and UK, the disclosure is provided in two parts. The information contained in this Part I constitutes the Compensation Discussion and Analysis ("CD&A") as required by the SEC and provides information on our named executive officers who are employed by OMAM Inc. Part II is set out inAppendix A and contains the OM Asset Management plc Remuneration Policy and Report as required in the U.K. by the Enterprise and Regulatory Reform Act 2013 and The Large and Medium-sized Companies and Groups (Accounts and Reports) (amendment) Regulations 2013, and provides information on both the executive and non-executive directors of OMAM. The following discussion and analysis of compensation arrangements of our named executive officers for 2014 should be read together with the compensation tables and related disclosures set forth below. In addition, this discussion contains information on certain compensation policies and practices that were modified in connection with our initial public offering in October 2014 to reflect our new public company status. These changes are reflected in the description of the 2014 compensation decisions and are also outlined in the section entitled "Compensation Plan Changes Post IPO". This Compensation Discussion and Analysis focuses on our named executive officers for 2014 which include our Chief Executive Officer, Chief Financial Officer and remaining three executive officers:•Peter L. Bain, President and Chief Executive Officer•Stephen H. Belgrad, Executive Vice President and Chief Financial Officer•Linda T. Gibson, Executive Vice President and Head of Global Distribution•Aidan J. Riordan, Executive Vice President and Head of Affiliate Management•Christopher Hadley, Executive Vice President and Chief Talent Officer Our CD&A is presented in four sections:•Our Executive Compensation Practices and Policies provides a summary of our Executive Compensation program along with subsections containing information on:•Comparator Group•Our Compensation Committee•Compensation Consultant•Risk Considerations in our Compensation Programs•Elements of Compensation including Cash Base Salary, Incentive Compensation—Cash and Equity and Benefits•Compensation Process and Elements outlines our compensation practices for fiscal year 2014. This includes an overview of:•2014 Cash Base Salary•2014 Annual Incentive Compensation•2014 Benefits•2013 Value Incentive Plan•One-Time Performance-Vested equity awards granted in 2015•Compensation Plan changes Post-IPO provides information on changes made after the public offering to:•Share Exchange from Old Mutual plc to OMAM•Equity Incentive Plan•Compensation Tables including information on current employment agreements.Our Executive Compensation Practices and Policies A compensation structure based on clear and consistent objectives, supported by a focused system of talent development and management, is a critical element of our business strategy. Our compensation program is designed to enable us to attract, retain and incentivize the highest caliber talent across our business in order to maintain and strengthen our position in the asset management industry. With respect to our named executive officers, our compensation methods are intended to provide a total rewards program that is competitive with our peers and supports our values, rewards individual efforts, and correlates with our financial success as a company. Following the initial public offering, the principles and objectives of our compensation practice have remained largely consistent with our Parent's compensation philosophy. Beginning with the 2014 compensation decisions, the responsibility for making our compensation policy and decisions shifted to a newly formed Compensation Committee. Our Parent reviews and approves the Compensation Committee's decisions. Our Parent's role in reviewing our compensation levels and programs will terminate if our Parent ceases to own a majority of the outstanding Ordinary Shares. Our compensation program is designed to contribute to our ability to:•support our business drivers, company vision, and strategy;•support and enhance our broader talent management practices and the achievement of our desired culture and behavior;•use performance-related incentives linked to success in delivering our business strategy and creating alignment with shareholder interests;•pay employees at levels that are both competitive and sustainable; and•manage risk. We aim to achieve these goals through a compensation structure that includes a moderate level of fixed compensation, as well as a larger portion of discretionary incentive compensation consisting of a combination of cash and equity. Incentive Compensation awards, while discretionary, are based upon agreed financial and operational objectives agreed at the beginning of each year. The only fixed component of compensation is base salary, which ranges from 7%-28% of total compensation for our named executive officers. Beginning in 2014, the equity component consists of both performance-vested restricted share units ("RSUs") as well as time-vested restricted share awards ("RSAs"). Details of thesplit between fixed and incentive compensation for 2014 for each of the named executive officers is provided in the following table: Title Fixed

Compensation

as % of Total

Compensation Incentive

Compensation

as a % of Total

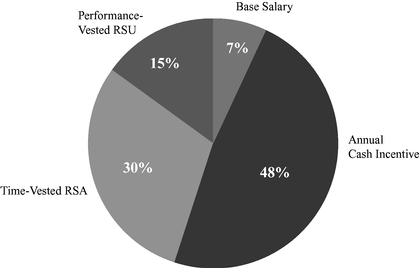

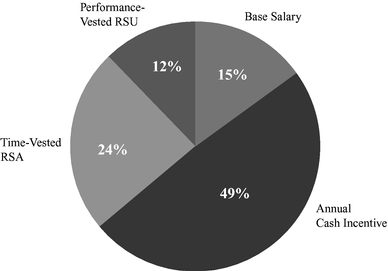

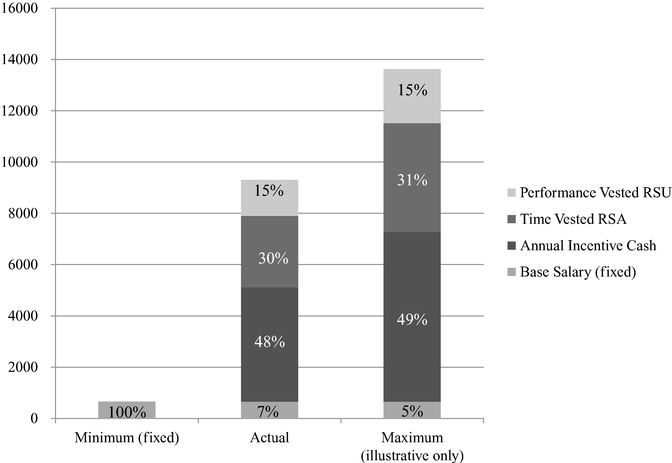

Compensation President and Chief Executive Officer 7 % 93 % Executive Vice President ("EVP"), Chief Financial Officer 13 % 87 % EVP, Head of Global Distribution 13 % 87 % EVP, Head of Affiliate Management 16 % 84 % EVP, Chief Talent Officer 28 % 72 % Our incentive opportunities are designed to align a substantial portion of pay to our performance. The charts below outline the percent of value of each element of 2014 compensation for our Chief Executive Officer and other named executive officers. The charts reflect incentives granted for the 2014 performance year, including performance-vested RSUs and time-vested RSAs awards made March 6, 2015. Because the grants were made in 2015 they will be reflected in the compensation tables in our proxy statement for our 2016 annual general meeting and not in the tables following this narrative.President and Chief Executive Officer ("CEO") Compensation Mix

Other Named Executive Officers Compensation Mix (average)